Boston Celtics vs. Desktop Metal, or how to lose a tons of money on 3D printing

The embarrassing story of former Unicorn of Additive Manufacturing

What does the current NBA champion have in common with a leading manufacturer of industrial 3D printers? Actually, just one sole thing — they are both based in Massachusetts, US. Boston Celtics are located downtown, and Desktop Metal is located next door, in Burlington. They are 15 miles apart — about half an hour by car.

So why am I even putting them together in one sentence? Because one organization was bought for $360 million and is now going to be sold for ~$5 billion, while the other was recently valued at ~$3 billion and is now being sold for less than $200 million… And, well, they are both from Massachusetts…

Big fish in the aquarium

Many people operating in the 3D printing industry look at the market from the inside of the bubble they are in. The bubble is very small, so what is happening inside it seems very big. Big is everything — the transactions that take place, the revenues that companies generate, and the opportunities that they have.

Of course, when you look at all this from outside the 3D printing bubble, they turn out to be tiny… Compared to the industrial machinery market (CNC milling machines, injection molding machines, etc.), they are downright ridiculous.

But the 3D printing bubble makes people feel important and the things they do in it seem huge.

Once Desktop Metal was a big fish in the aquarium. But thanks to the recent sale to Nano Dimension and the potential sale of the Boston Celtics — which happens completely independently and unrelated — we can see how tiny a fish it is in the entire ocean…

The greatest of growth

Somewhere around mid-2021, it was a great story. It started in October 2015, when Ric Fulop resigned from Markforged, an emerging startup in the industrial AM industry from the suburbs of Boston, and founded Desktop Metal.

Initially, it was a rather enigmatic company that was best known for serially raising funds for development. Its early investors included Google Ventures, BMW and Stratasys. Weird, but during the first year of operation, no one really knew what exactly this company does?

In April 2017, the aura of mystery disappeared — Desktop Metal presented two proprietary solutions — Desktop Metal Studio System and Desktop Metal Production System. They were supposed to revolutionize the metal 3D printing market in terms of speed, safety, quality, and reduction of manufacturing costs.

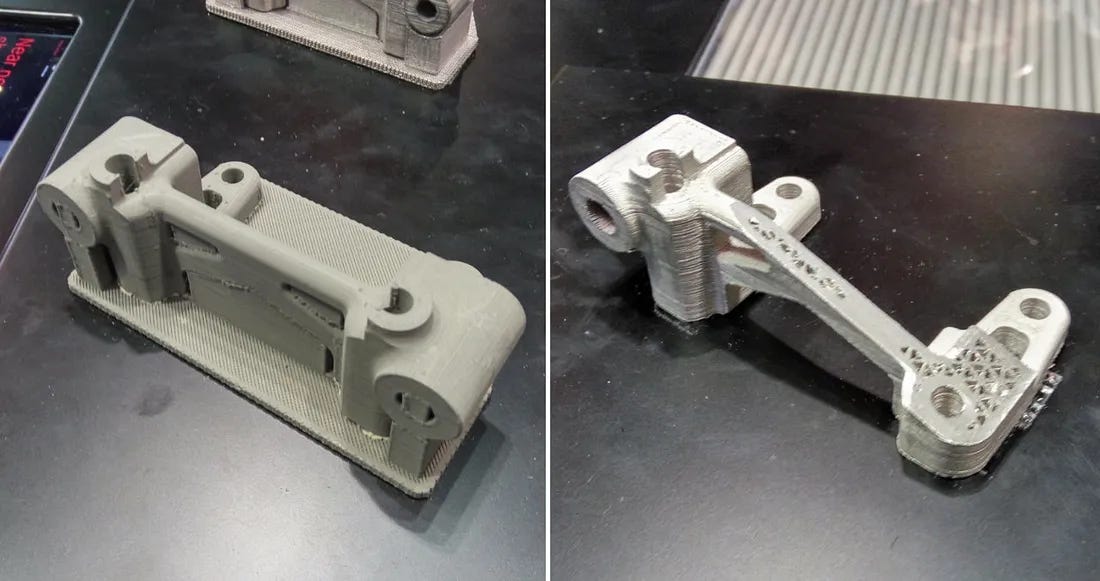

Desktop Metal Studio (DMS) was intended mainly for rapid prototyping and, due to its relatively small size, could be installed in any design office. The system consisted of a 3D printer and a special furnace intended for sintering.

In fact, it was an FDM/FFF 3D printer using rods made of a composite of metal and thermoplastic. The 3D printer printed the part, which was then rinsed of the polymer and sintered into the final form. It was actually office friendly, but it had a key flaw. The 3D printed parts shrank a lot during post-processing, so they had to be printed larger. It also caused natural limitations in their geometries.

Desktop Metal Production (DMP) was a system intended for mass production of metal parts and was advertised as the fastest in the world. This was made possible by Single Pass Jetting (SPJ) technology, which was almost a hundred times faster than 3D metal printers available on the market.

The machine was intended to significantly reduce production costs and become a real alternative to currently used methods of producing metal parts, such as casting.

In fact, it was BinderJetting technology. This method was neither new nor revolutionary — but it was very niche. It involved selectively spraying a binder onto metal powder. The parts assembled in this way were sintered in furnaces, and they also shrunk (by about 20%). 3D printers of that kind were developed, for example, by ExOne (which we will get to in a moment).

But all these technological nuances did not prevent Desktop Metal from shining in showrooms and meeting regularly with investors.

In January 2019, Desktop Metal became the best-funded 3D printing start-up in history!

The estimated value of the investments obtained was USD 438 million, and the company’s value was estimated at approximately USD 1.5 billion.

Of course, there were also stumbles along the way… For example, a several-year-long court dispute with Markforged over patents and unfair competition.

But at the end of 2019, all this was overshadowed by a great stock exchange debut! Even though Desktop Metal went public through the back door…

Unicorn

December 10, 2020 Desktop Metal did a reverse IPO merger with Trine Acquisition Corp., and started trading on the New York Stock Exchange (NYSE). The debut was spectacular, and the company exceeded a valuation of $1 billion.

In mid-January 2021, Desktop Metal did another unique thing by taking over one of the leaders in industrial 3D printing in the world — EnvisionTEC. This is a truly innovative company that has contributeda a lot to the development of additive manufacturing.

Established in the late 1990s, it created 3D printing technology from light-cured resins, using DLP projector as a light source. It was the first alternative resin-based technique to stereolithography, where layers of details were selectively exposed to a laser beam.

EniviosionTEC 3D printers are widely used in virtually every area of industry and medicine (they are used to produce, for example, earplugs for hearing aids or prosthetic protective overlays for teeth).

As a result of this transaction, in February 2021 the company’s share price peaked at more than $317 per share. The valuation reached ~$3 billion.

In mid-August of the same year, Desktop Metal announced the acquisition of ExOne — its only real rival in the area of 3D metal printing using BinderJetting technology (I mentioned that we will come back to this). In addition, there were a number of smaller acquisitions, such as Aerosint and Aidro.

Either way, the company has not only grown structurally, but also expanded its product portfolio into many, very different markets. For example, Desktop Health was created — a department focused on healthcare products in the fields of dentistry, orthodontics, dermatology, orthopedics, cardiology, plastic surgery, and 3D printed regenerative.

Marketing success in exchange for financial failure

Something for something… Marketing-wise, Desktop Metal looked perfect. It all came down to the promise that within the next 5 years, the AM industry would become a real, high-performance and cost-efficient manufacturing method, adapted on a wide scale by the whole industrial sector.

If this happens then Desktop Metal will be able to generate a $1 billion in yearly revenues, and in result it will be worth ~$5 billion.

Thing is, it didn’t.

Desktop Metal armed itself with great force, took over companies, burned gigantic amounts of cash on research and development, but… sales grew disproportionately slowly.

In percentage terms, these were amazing numbers.

For example, full-year 2021 revenues were $112.4 million, up +583% year-over-year. Organic revenue growth from sales of metal 3D printing machines alone increased by +163% compared to 2020.

But all this was disproportionate to the investment. To achieve all this, Desktop Metal had to spend twice as much money as it was able to earn… The loss for 2021 was -$240.3 million.

As a consequence, the stock price began to decline, as sales growth never met the projections. In the prospectuses, the forecast for 2023 sales was $329 million, while Desktop Metal generated only $190 million last year.

It no longer looked like overblown forecasts, but began to smell like a fake…

Stratasys to the rescue

Ric Fulop began announcing rescue plans that amounted to cutting costs by laying off people. But in the meantime, management also began to understand that continuing their journey on their own was unlikely to have a happy ending. They began to look for alternative solutions.

So Stratasys appeared.

Then it was said that it had all been planned for a long time — that Stratasys looked at Desktop Metal with love from the moment they first met. The fact is that the Israeli-American AM industry leader was looking for a new path itself.

Having most of the popular 3D printing technologies on offer, the only thing missing was metal 3D printing. Desktop Metal was intended to provide this.

Stratasys also had problems with its largest shareholder — Israeli Nano Dimension (a company with an even more complicated situation than Desktop Metal), which tried to take over them against their will.

So on the night of May 24, 2023, it was announced: Stratasys and Desktop Metal are merging in a deal worth $1.8 billion.

The transaction was expected to close in the fourth quarter of 2023 and was subject to customary closing conditions, including approval by Stratasys and Desktop Metal shareholders, as well as the receipt of certain governmental and regulatory approvals.

But then Nano Dimension entered the scene and announced that this deal is very bad and everyone would lose. Especially Stratasys shareholders (Nano itself). And it started torpedoing the deal.

Then 3D Systems — Stratasys’s largest market competitor — stepped in and said that they should merge with Stratasys. And that Desktop Metal is a failure and everyone should forget about them.

Public squabbles lasted for several months. They took place in the Staratsys — Nano Dimension — 3D Systems triangle.

In this dispute, Desktop Metal was treated like a child from an orphanage that no one wants. The company, recently valued at $3 billion, was portrayed as a money burner.

Ultimately, nothing came of it. First Nano Dimension withdrew altogether, then 3D Systems too, and at the very end Stratasys shareholders vetoed the merger with Desktop Metal.

It stayed the same. Except for one — all of them — especially Desktop Metal — lost their image significantly.

Lovelost

People stopped loving Desktop Metal. The share price plummeted. The loss was over 90%.

At the end of November 2023, Desktop Metal received a notice from NYSE indicating that the company did not comply with the standards for continued listing on the stock exchange. The reason for the notice was that the company’s average closing stock price was less than $1.00 over the next 30 trading days.

Company was given six months to improve the price. One of the options to solve this situation was the so-called reverse stock split. And this what finally happened — on June 2024 the Board of Directors of Desktop Metal approved a reverse stock split in a ratio of 1 to 10.

Unfortunately, this operation has not yielded positive results, as in following week after the reverse stock split, Desktop Metal reached a new 52-week low. The company stock was traded for $3.82. In February 2021 share price was $317.

A plot twist — Nano Dimension to the rescue

If this was described in a book or a movie, people would say it makes no sense. A stupid idea by the author or screenwriter to force some shocking plot twist.

But it really happened.

On July 3, 2024, Nano Dimension announced the acquisition of Desktop Metal. Yes, the same Nano that mocked Desktop publicly and said that it burns money by tons and is a deadly threat to Stratasys.

And yet they bought it.

Nano Dimension will buy Desktop Metal for $135 — $183 million in cash depending on their expenses and whether they will borrow more money from Nano to keep operating before the acquisition is completed.

If completed, the deal would lock in a loss of at least 98% in stock value for Desktop Metal since aforementioned February 2021.

There are still many things that can happen. The situation from a year ago may repeat itself, when Stratasys shareholders vetoed the merger with Desktop Metal.

But if not then… This will be one of the most spectacular failures of the 3D printing industry in history.

Do you know what Yoav Stern, CEO of Nano Dimension, said about Desktop Metal?

It’s like buying a property for $10 million in a prime location, but the house is not renovated. Now Ric has renovated, and the price is less.

Brutal.

And what does the Boston Celtics have to do with all this?

- Admit it, you did it for clickbait, right?

- No. Really. I’m explaining it to you right now…

Well, at the very beginning I wrote about the 3D printing bubble. This may seem strange or funny to people who are not in the AM industry, but for participants of this market, companies like Stratasys, 3D Systems, Desktop Metal, EOS, Materialise and many similar ones — are large corporations.

Serious players. Companies shaping the industrial reality of the world.

Did you know that none of these companies have ever generated a billion in revenue in fiscal year? No 3D printing company in history has achieved this.

That’s why 3D Systems was so keen to merge with Stratasys. To finally be the first to make it.

Desktop Metal really promised a billion in revenue. Meanwhile, three years after making this promise, it could not break the $200 million barrier. Annually!

Now let me tell you something about the Boston Celtics…

last year Jaylen Brown signed the richest contract in NBA history for $304 million in 5 years; in the first year (2024–2025) he will get $52.4 million and in the last year (2028–2029) $69 million

this year Jason Tatum broke this record by signing a contract worth $315 million in 5 years

also this year Derrick White agreed to a four-year, $125.9 million contract extension.

I’m leaving out other key players under valid contracts like Jrue Holiday and Kristaps Porzingis, who earn $30 million each year.

Currently, the Boston Celtics will spend nearly $200 million in guaranteed contracts for the upcoming season (but this is the time to sign new contracts, the season starts only in the fall, so these numbers may change).

Where am I getting at…?

Desktop Metal — the unicorn of the AM industry, and the best-funded 3D printing start-up in history, is sold for 135–183 million dollars, while two local basketball stars are guaranteed over 300 million each for 5 years.

As for the Boston Celtics themselves — after winning the championship in the summer, the current owners also put them up for sale. Approximate quote? $4.5 billion, but experts say it may exceed $5 billion.

Now look at this…

According to Forbes, the Celtics are the fourth most valuable NBA team, with an estimated value of $4.7 billion. That represents an increase in value of 1,205.56% from the sale price of $360 million that Grousbeck and his group paid for the franchise in 2002. [source]

After reading all this, tell me - what is the point of investing in 3D printing? Why not just hoop?

I encourage you to do this:

Get out of the bubble.

Look at it from a distance.

Compare the incomparable.

Ask the question: why you do this?

This article was originally published on Medium on July 6, 2024.