The current market cap of 3D Systems is the lowest since 2008...

The Atomic Layers: S9E21 (00258)

Atomic Layer of the Day:

3D Systems remains one of the largest and most important companies in the global AM industry.

Although recent years have seen a steady decline in revenue ($440.1 million in 2024), it's still a level most other companies in the market can only dream of.

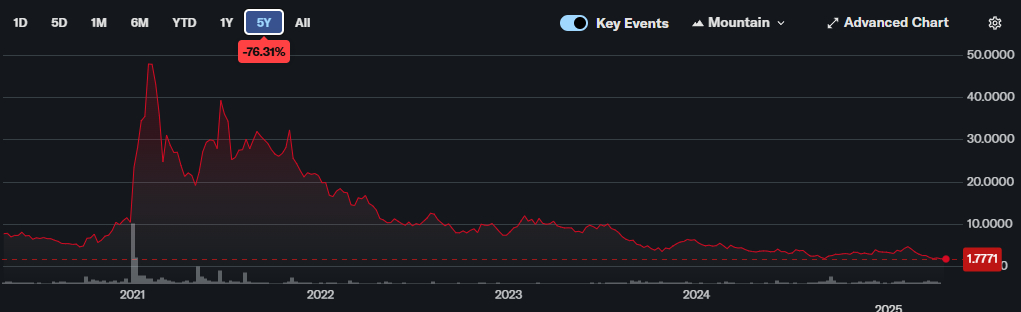

Yet, its market capitalization has dropped dramatically.

Today, the U.S. stock market values 3D Systems at just under $240 million—a far cry from its $9.55 billion valuation in 2013 or even $2.75 billion in 2021.

Of course, I’m well aware that the U.S. stock markets have been volatile ever since Trump’s economic policy experiments with tariffs and global trade fundamentals. But the point is—Stratasys hasn’t experienced such a dramatic plunge, despite facing similar long-term challenges.

In reality, 3D Systems has been on a slow stock market decline since the end of 2023.

To me, the company’s problems stem from a recurring identity crisis. From its inception until the late 2000s, 3D Systems was firmly focused on 3D printers for rapid prototyping, based on three technologies: its proprietary SLA, SLS (acquired from DTM), and its own MJP process.

Then came the hype around consumer 3D printing, which launched the company’s valuation to nearly $10 billion.

But soon after, the bubble burst, and 3D Systems crashed hard. With a new management team led by Vyomesh Joshi, the company returned to its industrial roots—just in time for the second wave of AM hype on the stock market.

However, under current CEO Jeff Graves, the company began shifting toward medical applications—on one hand, dental (with Align Technology as its flagship client), and on the other, bioprinting, following the acquisition of Allevi and the creation of Systemic Bio.

But unexpectedly to 3DS, Align Technology gradually became more independent, even acquiring Cubicure—a company that competes with 3D Systems. Meanwhile, bioprinting turned out to be an exciting but distant future prospect.

And the foundations of the medical specialization have once again started to buckle a little under their own weight...

Then came the infamous 2023 merger drama with Stratasys, which exposed many of 3D Systems’ vulnerabilities—like its deep financial dependence on orders from Align Technology.

Looking back, that failed merger may have been the turning point in how seriously the stock market viewed 3D Systems.

Still, that judgment feels somewhat unfair. Even if 3D Systems were to collapse—it’s unlikely to happen this decade. It would take something truly unexpected to make that scenario plausible. In reality, the company’s position remains relatively strong, and despite market turbulence, such a drastic drop in valuation doesn’t reflect its true standing.

3D Systems is still trying to find its footing in a shifting landscape, but judging its value solely by stock performance misses the bigger picture.

Atomic Layer from the Past:

04-21-2022: Ultimaker released Cura 5.0, powered by the Arachne engine.

News & Gossip:

Titomic - Australian cold spray technology provider, has secured two strategic deals: a materials partnership with Metal Powder Works to optimize powders for its Kinetic Fusion systems, and a collaboration with Northrop Grumman to develop high-performance aerospace pressure vessels.

Walmart has opened two 3D-printed commercial extensions, including a 5,000-sq-ft Alabama warehouse built in just seven days by Alquist 3D—twice as fast as its prior Tennessee project. Using robotic concrete printers, the project required only five workers instead of 20-30 for traditional methods.

Unionfab, the service bureau owned by China’s UnionTech, has officially announced that it is the world’s largest industrial 3D printing service provider in terms of installed machine count. Unionfab operates a fleet of nearly 800 industrial 3D printers. The company handles orders ranging from 1 to 100,000 units and serves over 30,000 clients worldwide, including several Fortune 100 companies. Their lineup of technologies and machine manufacturers includes both domestic Chinese providers (such as UnionTech, Farsoon, and BLT) and global players like EOS, Stratasys, SLM Solutions, and HP. For a deeper dive into Unionfab’s operational scale and the wide spectrum of AM technologies their machine park covers, I recommend reading

’s article on VoxelMatters.