The puzzling story of Velo3D

How one of the most innovative AM companies dropped to the level of a penny stock

It’s really hard to explain.

While history knows several cases of AM companies that quickly fell from the top of the industry, they usually:

had technology that didn’t stand the test of time (Z Corporation, Solidscape),

were simply bad and operated purely on hype (Cubify, Robo 3D),

released new but highly disappointing products (MakerBot, Zortrax),

or were simply overtaken by competitors (EnvisionTEC by Formlabs, Ultimaker by Prusa, Prusa by Bambu Lab).

The case of Velo3D is different. The company developed a unique, proprietary technology, gained market recognition, and its products reached top industrial production clients. It obtained all the necessary certifications and approvals for implementation in strategic sectors of the country. It entered the stock market with a bang, reaching an incredible valuation of $2.24 billion.

And then, it all suddenly crumbled like a house of cards.

Or rather — it’s like someone was painstakingly setting up a complex domino line, and suddenly, the tiles start falling in the middle of the process. Everything has to be started over from scratch.

That’s roughly what Velo3D’s current situation looks like.

Its founder, Benny Buller, has been out of the company for over half a year.

After receiving sequential letters from the NYSE regarding non-compliance with its standards, the company was delisted from the stock exchange this week.

As a result, it moved to the much less prestigious OTCQX market, and its stock valuation has plummeted to an embarrassing $5 million.

For comparison, the average NBA player made $10,277,000 USD for the 2023–24 season.

This was supposed to be a beautiful story, but instead, it’s turned into a real tragedy.

How it started

Velo3D was founded in 2014 by Benny Buller in Campbell, California, USA. In 2015, it raised $22 million in funding and worked in deep secrecy on an unspecified revolutionary metal 3D printing method. (It later turned out that over $90 million had actually been raised).

Similar to Desktop Metal (which was founded around the same time), Velo3D was surrounded by an aura of uniqueness and high expectations. And while Desktop Metal delivered rather less than expected, everyone agrees that Velo3D truly hit the jackpot.

In August 2018, everything became clear… Velo3D’s big secret was a metal 3D printing process that offered unparalleled design freedom compared to legacy methods like PBF.

The Velo3D Sapphire System could print complex geometries below 45°. The company also developed its own supporting software — Flow.

Velo3D’s Sapphire enabled the printing of parts with overhangs lower than 5° and large inner diameters without supports. This translated to a 30–70% reduction in part manufacturing costs.

Some applications could even be 3D printed free-floating in the powder bed from alloys like Inconel 718 or Titanium.

The ability to print such specific and challenging geometries, especially for metal PBF, was made possible by Velo3D’s proprietary Intelligent Fusion technology, which relied on process simulation, prediction, and closed-loop control.

Thus, the key innovation and the foundation of Velo3D’s future success was simulation, which had always been very difficult for metal 3D printing.

The company’s claim of a 90% success rate on the first part print was a game-changer. At the time, it was standard for operators to make several attempts to print complex parts correctly. This involved positioning the part on the build plate and supporting it in such a way that it wouldn’t warp, detach from the platform, or be damaged during support removal.

Metal 3D printing was still a game of “will it work or not?”. Companies would use kilograms of powder to optimize part placement on the machine and solve complex problems like thermal stresses.

Velo3D promised to solve this.

Its 100-person team developed simulation tools that allowed for high repeatability. They created a real-time monitoring system for the molten pool and correlated it with material dosing and laser control. This allowed them to correct deformations on the fly through cooling, reducing laser intensity, or adjusting melting speed.

Paradoxically, with all these improvements, designers creating parts for metal 3D printing had to learn how to design them again because… they gained much greater freedom and the removal of many previous constraints.

How it developed

Velo3D became one of the most popular companies in the AM industry, with high expectations tied to it in the USA. During the 2010s and early 2020s, metal 3D printers were manufactured outside of North America.

3D Systems — which offered them after acquiring France’s Phenix and Belgium’s LayerWise — produced them in Europe. GE Additive, which acquired Germany’s Concept Laser and Sweden’s Arcam, produced them in Europe. German companies EOS and SLM Solutions produced them domestically — in Germany, Europe. Chinese companies… well, you obviously know.

So, Velo3D gained popularity in America because it was local.

And a spectacular streak of successes began…

In the midst of the C19 pandemic, Velo3D raised $40 million overall and increased its total fundraising to $150 million by that time.

In July 2020, Velo3D received its largest order in history — an existing aerospace customer placed an order worth $20 million. (We all decided to believe it was SpaceX).

In August 2020, the company announced a joint development agreement with Lam Research Corporation — a wafer fabrication equipment and services supplier to the semiconductor industry.

In September 2021, it went public on the New York Stock Exchange (NYSE) through a SPAC merger with JAWS Spitfire Acquisition Corporation, securing an additional $274 million in funding.

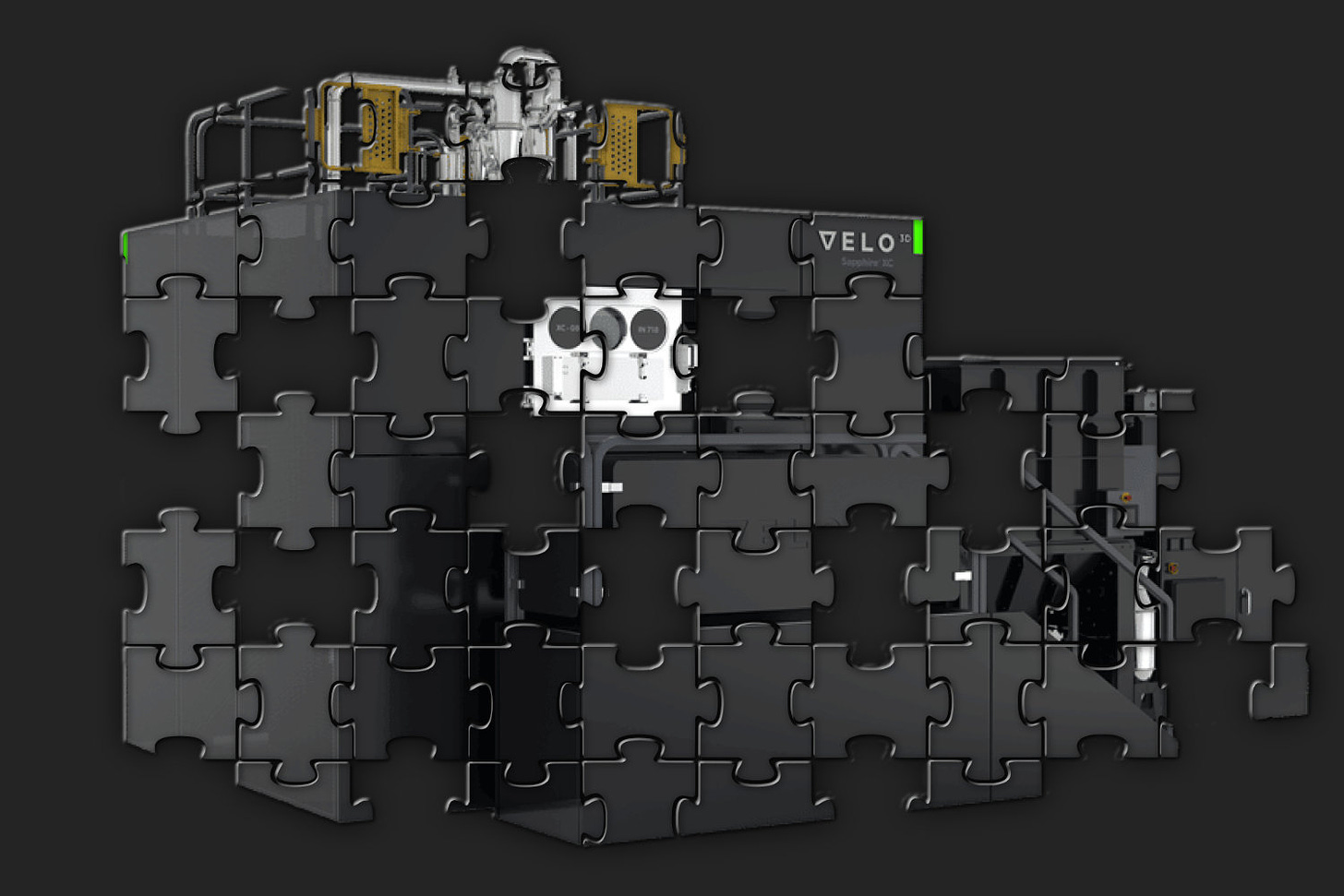

Its flagship products became the Sapphire XC and Sapphire XC 1MZ 3D printers.

In August 2023, the veteran of the industry — former EOS CEO Dr. Adrian Keppler — joined the Board of Directors.

Keppler’s presence, of course, had no direct impact on what was happening, but problems at Velo3D started to become more visible. The company was expanding too fast, operational losses deepened, and cash was burning…

For the third quarter of 2023, Velo3D reported mixed financial results, missing earnings expectations. Despite a year-over-year revenue increase and sequential improvement in free cash flow, Velo3D announced a significant workforce reduction at the level of ~20%. Revenue climbed to $22.4 million, up from $17.8 million in the same period last year, yet the company registered a net loss of $17.1 million.

In early December 2023, the company announced perhaps its last spectacular success to date. Velo3D became the first metal 3D printer manufacturer with the highest-level cybersecurity compliance — the Green Security Technical Implementation Guide (STIG) Compliance with the US Department of Defense (DoD).

Velo3D’s technology became strategically important from a national defense perspective.

And then — completely unexpectedly — Benny Buller announced his resignation as CEO of the company he founded. He was asked to step down by the Board of Directors.

His successor was Brad Kreger, who joined Velo3D in December 2022 as the Executive Vice President of Operations.

Buller stepped down while the company was experiencing growth but also significant financial challenges. Over the course of the year, total revenue grew to $100.843 million — a substantial leap from $18.975 million in 2020. However, it suffered great operational losses of -$99.676 million during the same period. Velo3D’s operating cash flow was deeply negative at -$113.947 million.

So Benny had to go…

As it turned out, from that moment on, everything went downhill — and in a real sprint, not a stroll.

How it ends…

Despite what seemed like a fantastic future, 2023 ended disastrously for Velo3D. This is how the company’s new CEO, Brad Kreger, commented on it:

2023 was a transformational year for the company. Our focus on a hyper-growth business strategy at the beginning of the year significantly impacted second-half performance as multiple new product introductions and rapid expansion of our install base led to material increases in field system issues and customer concerns, (…)

Similarly, as we expanded beyond our early adopters of the technology to broader markets, we found our sales methodologies did not translate effectively, leading to poor opportunity qualification. These issues directly affected our bookings rate as evidenced by our very disappointing fourth-quarter results.

The NYSE began sending Velo3D notices of non-compliance with their listing rules. Similar notifications were received by other companies in the AM industry, such as Shapeways, Markforged, and Desktop Metal. However, Shapeways eventually went bankrupt as a result…

In July, Velo3D announced a reverse stock split to avoid being delisted from the exchange.

The first quarter of 2024 was better for Velo3D than the end of 2023, but the company was still burning through cash. Unfortunately, the second quarter was weak again. The company couldn’t replicate the strong results from 2023.

In any case, summer ended, autumn came, and dark clouds first gathered over the company, soon followed by heavy rain.

The market valuation plummeted dramatically. By the end of the summer, it was around $12 million (a humiliating figure considering the company’s history).

Eventually, the NYSE had enough of waiting for a better future. Due to a persistently low stock price and a market valuation below $15 million, Velo3D has just been delisted from the exchange.

The decision was based on Section 802.01B of the NYSE’s Listed Company Manual. Although the company has the right to request a review of this determination by a Committee of the Board of Directors of the Exchange, it decided to change course and move to a different exchange:

Velo3D (…) the leader in scalable metal 3D printing technology for production manufacturing, today announces that its common stock anticipates the commencement of trading on the OTCQX® Best Market under the symbol ‘VLDX.’ The company previously traded on the New York Stock Exchange.

Trading on the OTCQX Best Market offers more than 12,000 companies efficient, cost-effective access to the U.S. capital markets. Streamlined market requirements for OTCQX are designed to help companies lower the cost and complexity of being publicly traded, while providing transparent trading for their investors. To qualify for OTCQX, companies must meet high financial standards, follow best practice corporate governance, and demonstrate compliance with applicable securities laws.

Trading on OTCQX under the symbol “VLDX” began on September 11, 2024 — a very unfortunate date for Americans…

Moreover, while the OTCQX lets companies stay publicly traded with fewer reporting requirements (and lower costs), it often means less visibility and lower trading activity.

As a result, the valuation has fallen to a disastrous $5 million. That is penny stock valuation. That is miserable.

At its peak, Velo3D was valued at $2.24 billion. The drop to $5 million means a decline of -99.8% from its peak valuation.

Anyone who bought the company’s shares at that time and didn’t sell them has lost everything.

What’s next?

It’s uncertain… Will Velo3D even survive?

Zachary Murphree, who started at Velo3D as Director of Product and Applications and later advanced to VP of Global Sales and Business Development, left the company along with Buller.

Now he has been brought back to save the sinking ship.

Can the company return to its previous valuation?

Currently, the question is whether it can even return to a normal valuation.

Why isn’t anyone buying it, given how cheap it is?

I don’t know. Five million dollars — I don’t think anyone is waiting for the valuation to drop further.

Unless something is happening behind the scenes that we are unaware of or don’t fully understand?

Maybe acquiring the company would mean taking on “the other things” besides just the technology, patents, certifications, and customer base?

There’s a company in Poland called Zortrax. At one time, it was a market leader in desktop 3D printers. Many people, companies, and institutions have tried to acquire them. But every attempt failed… Something was buried deep in the documents that each and every time stopped potential buyers from doing so. Today, that company is dying…

Maybe it’s the same case here?

The situation with Velo3D is very dynamic. It’s possible that a day, a week, or a month after this article is published, the company’s situation could look completely different.