38 and 35 years. That’s how long 3D Systems and Stratasys have been around, respectively. These are the two oldest companies in the AM industry. In fact, 3D Systems was the very first…

Both companies offer practically all the most popular additive techniques on the market, utilizing all the key materials in their work. 3D Systems remains the global leader in industrial resin machines (SLA), while Stratasys leads the world in thermoplastics (FDM) and inkjet resins (PolyJet).

For 20 years, they held all the key patents on AM technologies, blocking independent (competitive) development by other companies. Even now, they still hold enough related patents to potentially leverage them against competitors at any time (see the 2024 Stratasys vs. Bambu Lab patent lawsuit).

The 2024 Patent War

It seems the folks at Stratasys decided, “Alright, enough messing around,” and went after Bambu Lab.

Over the years, they’ve acquired about a hundred companies, both large and small, expanding their product portfolios with new technologies, as well as with unique and original materials and software.

For a long time, they have occupied the top two positions in the industry in terms of revenue.

3D Systems and Stratasys are the largest, most influential, and generate the most money.

Yet, they still disappoint.

They still haven’t reached the level they should have achieved long ago.

And who says so? Pretty much everyone… Investors, shareholders, customers, competitors. Even the companies’ CEOs themselves. No one is satisfied. Everyone wants more. Everyone thought they would be further along by now.

But they are still in the same place. That place is called half a billion dollars in annual revenue.

+/- 100 million. Sometimes it’s more, sometimes it’s less.

And there’s still an operating loss.

But that’s not all. At the end of August 2024, Stratasys — the industry leader in revenue for several years — announced that they have to lay off 15% of their workforce. Because things are that bad.

And just a bit earlier (mid-August), they announced they are leaving their historic headquarters in Eden Prairie and moving to a nearby campus where they will lease space. They plan to sell their buildings because extra cash is more needed than ever…

3D Systems? Don’t get me started…

Over three decades in the market (nearly four for 3D Systems), and these companies still face the same problems. Even if they surprise with something big in a given reporting period, two or three quarters later, they disappoint again. And repeat.

I’ve been observing this day by day for 11 years.

And I ask myself: What’s the point? Why are you doing this?

Dismal financial results

Let’s do this quick. There won’t be any deep financial analysis or copying and pasting tables. That’s not the point here.

First of all, let’s be honest — it’s not just 3D Systems and Stratasys that are struggling. It’s not just AM companies that are doing worse.

The global situation is bad overall — economically, politically, socially. Wars are raging in several places. Even though these wars are local, they’re backed by other major countries. They might stay local, or they might suddenly spread across the world.

This has happened before. It wouldn’t be the first or even the second time…

All of this doesn’t favor business development, especially in R&D for new technologies. In times of war and economic crises, old, proven manufacturing methods thrive. No one wants to take risks with something untested and new.

The thing is, 3D Systems and Stratasys aren’t startups. They are seasoned, veteran companies. In industrial manufacturing, everyone knows them well. Every major industrial corporation in the world has or had machines from one of these two.

Their machines should be running at full capacity, especially in defense. Oh, and I forgot to mention, both companies pay a lot of attention to bureaucracy. They have all the necessary certifications, studies, and permits.

So even if their machine loses on price somewhere, it wins because the competition can’t sell their solutions due to formal restrictions.

Again — their machines should be everywhare and work at 100% capacity and produce parts that cannot be produced otherwise.

Right?

Well, not exactly…

Let’s see what do the actual numbers look like?

3D Systems

Let’s start by noting that the company reported its financial results for the first quarter of 2024 only in the middle of the third quarter… This delay was due to prolonged audits, which themselves proved to be financially burdensome for the company.

Revenue for the first quarter of 2024 was 15% lower than the same period last year. 3D Systems generated $102.9 million compared to $121.2 million the previous year.

The operating loss deepened from $-33.396 million in Q1 2023 to $-39.862 million in Q1 2024, reflecting a +19.4% increase in operating loss. Despite a reduction in sales costs, the revenue decline negatively impacted the operating result. However, the net loss decreased from $-29.529 million in Q1 2023 to $-16.101 million in Q1 2024.

The first-quarter results were published on August 20, 2024, and the results for the second quarter (and the entire first half of the year) were released just 9 days later.

And they turned out to be comparable to those from the first quarter.

Thus:

Revenue decreased by 11.7% to $113.3 million compared to the same period last year, when the company generated $128.2 million.

Revenues declined across all segments: Healthcare Solutions decreased by 19.7%, Industrial Solutions decreased by 4.4%.

The net loss was $-27.3 million compared to a net loss of $-28.9 million for the same period last year.

As for the entire first half of the year, revenues fell by 13.3% (from $249.4 million in 2023 to $216.2 million in 2024). However, the net loss decreased from $-58.3 million to $-43.4 million.

The company expects to close the year with revenues in the range of $450–460 million.

Stratasys

As for Stratasys, it did better than 3D Systems, but still bad.

In Q2 2024, Stratasys generated $138 million in revenue, compared to $159.8 million in the same period in 2023, marking a -13.59% year-over-year decline. For the first half of the year, the company generated $282.1 million in revenue, compared to $309.13 million in 2023, representing a -8.75% decline. The net loss for Q2 was -$25.74 million, a reduction by one-third compared to last year’s loss of -$38.6 million. The loss for the first half of the year was -$51.73 million, compared to -$60.84 million in 2023.

The company’s revenue declined similarly in both product sales (3D printers and materials) and services provided.

In result, Stratasys has announced a significant restructuring plan, including laying off 15% of its workforce. The company employs a total of 1,980 people worldwide, including 537 in Israel. While Stratasys did not disclose the exact number of layoffs, it is estimated to be around 300 employees, including about 80 in Israel. This is expected to result in $40 million in annual cost savings starting in Q1 2025.

The company expects to close the year with revenues in the range of $570-$580 million.

Historical perspective

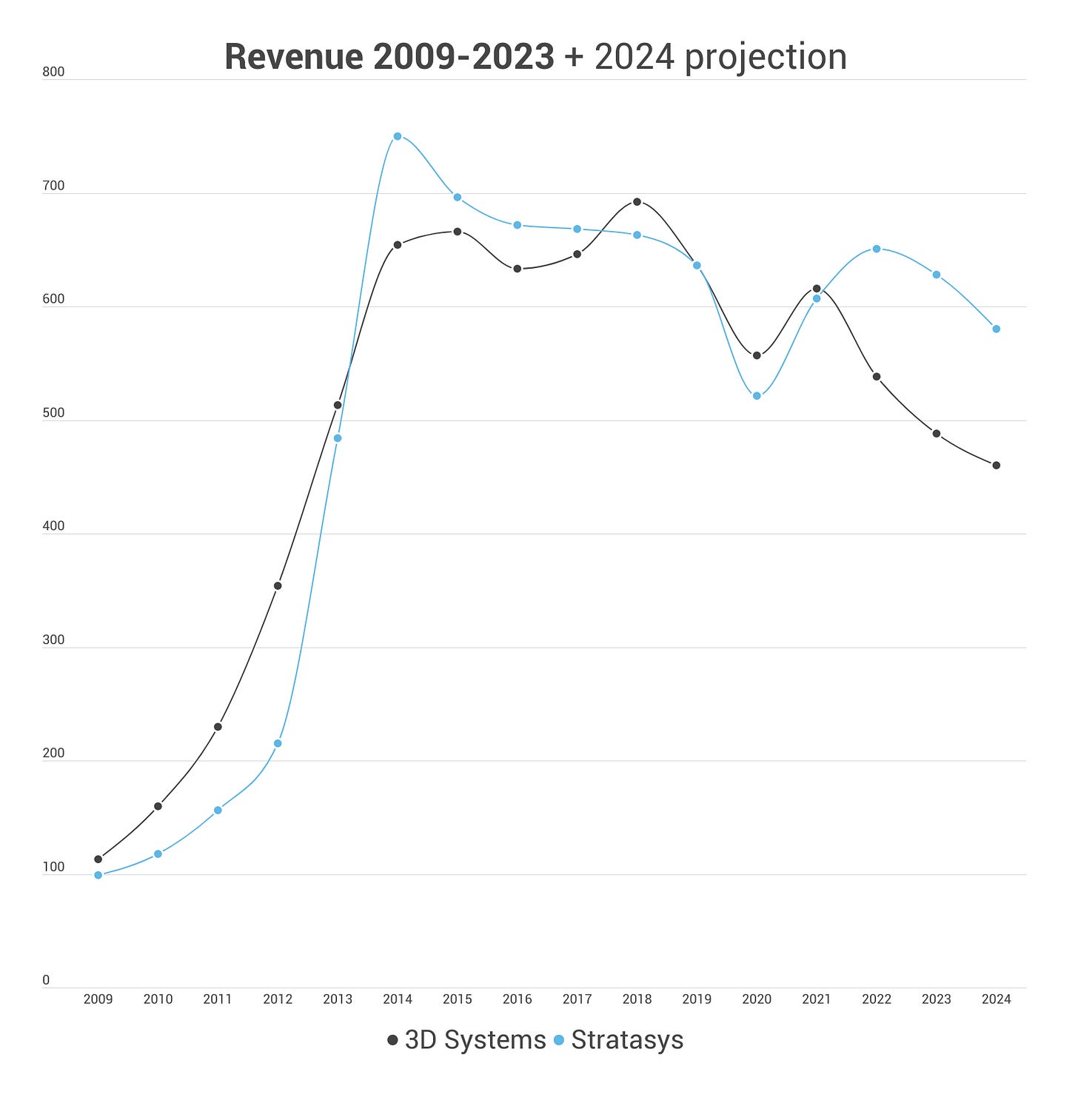

Comparing the revenues generated by both companies over the past 15 years (plus the forecast for 2024), it looks like this (gray for 3D Systems, blue for Stratasys; values in millions of dollars):

3D Systems achieved its best result in 2018, generating $692 million in revenue.

Stratasys reached its peak in 2014, with revenue of $750 million.

Both companies experienced significant revenue declines during the COVID-19 pandemic (2020), though the downward trend was already visible earlier.

After the pandemic, both companies managed a financial rebound, but in the case of 3D Systems, this was largely due to the sale of certain assets (such as its 3D printing services division). Excluding the post-pandemic recovery, 3D Systems has been steadily decreasing its revenue since its peak in 2018.

The dream of $1 billion in revenue

The AM industry is nearly 40 years old, as old as 3D Systems itself.

Despite this, none of the companies in the industry have ever managed to reach $1 billion in annual revenue. It’s still a goal that everyone is striving for.

Remember last year when Stratasys wanted to acquire Desktop Metal, but Nano Dimension blocked it because they wanted to acquire Stratasys themselves? Then 3D Systems jumped into the fray, announcing they would acquire Stratasys? This whole saga lasted for several months and ultimately led nowhere.

The main motivation behind all of this was to finally create a company capable of reaching $1 billion in annual revenue.

Today, we know that the merger of Stratasys and Desktop Metal wouldn’t have guaranteed that goal. The idea of Nano Dimension acquiring Stratasys was laughable from the start (their annual revenue is less than Stratasys’ quarterly revenue). Only the merger of the two largest and oldest companies could have made it possible.

Although, as we see now, it would have been a close call (projected max: $460M + $580M).

Why create a company with $1 billion in revenue? My theory is that it’s about trying to sell it off at a good price. But that’s not going to happen now. The companies couldn’t reach an agreement, and they won’t achieve this on their own. Not in the near future.

As for Stratasys, I fully understand. For the past few years, they’ve been the industry leader, and being „acquired” might have been “beneath them.” At the end of the day, it’s always about the egos of those at the helm.

As for 3D Systems, it was already clear back then that the company didn’t have many options left. A merger with Stratasys was a very favorable solution for them. Today, they might slowly be entering desperation mode.

Which brings us to the main question…

Why you do this?

What is the goal? What will we see at the end of the road?

Is there anyone in the AM industry who truly believes that in a year, two years, or maybe five, 3D Systems or Stratasys will finally get their act together and do something so impressive that it will leave us all in awe?

Is there?

The truth is that both companies have been around for so long that, by default, they are the largest and sell the most. But as the results show, they are selling less and less.

They are at the top simply because their potential competitors in the US and Europe are even smaller and weaker. But that’s also slowly changing.

HP is doing a really strong job in AM. Nikon SLM is just starting to gain momentum. And let’s not forget about GE (Colibrium Additive).

And then there’s China.

In terms of market valuation, BLT (Xi’An Bright Laser Technologies) is worth more than three times as much as Stratasys and nearly five times (4.8) more than 3D Systems. Farsoon Technologies is valued at 1.4 times more than Stratasys and over twice as much as 3D Systems.

This really doesn’t look good.

On its 35th anniversary, Stratasys is vacating its headquarters for cost-saving reasons and laying off 15% of its employees. Okay, sometimes that happens. But it would be justified if the company had really seen some golden years.