Yoav Stern loses his seat on Nano Dimension's board - will this jeopardize the acquisition of Desktop Metal and Markforged?

The Atomic Layers: S5E8 (00124)

Atomic Layer of the Day:

The problem with Nano Dimension is that, from the perspective of its activities within the 3D printing sector, it is quite an interesting company. Unfortunately, its ambitions—or rather the ambitions of its CEO, Yoav Stern—are disproportionate to what it can achieve on its own. And it is precisely these excessive ambitions that have brought the company to its current position.

The origin of the problem

Originally, Nano Dimension was one of those 3D printing companies that garnered a lot of attention, but its offerings were so specific and specialized that its products were used by a relatively narrow group of customers.

The Israeli company initially produced proprietary, specialized machines for additive manufacturing of electronics at the nano-technological level, which were supposed to “revolutionize” the electronics market. This promise sounded extremely attractive, but it remained, and still is, a very niche solution.

For the first few years, Nano Dimension floated along the waters of the AM industry, occasionally publishing modest news about its achievements to remind the market of its presence.

This changed after the COVID-19 pandemic. The company amassed over $1.5 billion through stock offerings in 2020–2021. This was an enormous amount of money for the AM industry and an extraordinary sum for a company as small as Nano Dimension. The firm benefited from the sudden surge of interest in 3D printing technologies and the corresponding boom in tech stock markets.

These funds were raised through several rounds of public stock offerings on NASDAQ, which were made possible by growing investor confidence and enthusiasm for the potential of the 3D printing market in sectors such as aerospace, electronics, and defense. This strategy allowed the company to build a significant financial cushion.

The catch, however, was that no one really knew what to do with all that money. Spending it on internal needs seemed pointless… In fact, given the specificity of Nano Dimension’s technology, it was probably impossible. Thus, the idea of acquisitions arose.

In November 2021, the company acquired Essemtec, a firm specializing in assembling electronic components on PCBs.

In January 2022, it acquired Global Inkjet Systems, a producer of hardware for 2D and 3D inkjet printing used by companies like Fujifilm Dimatix, Konica Minolta, Kyocera, Ricoh, SII Printek, Toshiba TEC, and Xaar.

In July 2022, it acquired Admatec and Formatec, companies specializing in 3D printing with ceramics and metals.

But all of this was still too small to satisfy the ambitions of the company’s charismatic CEO, Yoav Stern. On July 18, 2022, he made a spectacular move on the leader of the entire AM market, Stratasys, by acquiring 12% of its shares!

The Stratasys saga

This was unprecedented. Moreover, it so alarmed Stratasys that the company undertook a series of measures to prevent Nano Dimension from purchasing additional shares (a so-called poison pill strategy).

This irritated Yoav Stern, who launched his infamous crusade to take over Stratasys. In March 2023, Nano Dimension submitted a $1.1 billion offer for Stratasys. After it was rejected, Stern kept coming back every few weeks with new offers. To complicate matters, Stratasys then pursued a merger with Desktop Metal, and finally, 3D Systems joined the fray.

Many of you are familiar with this story. Nothing came of it, and the only real beneficiaries were the lawyers on all sides, who made a fortune from this nonsense.

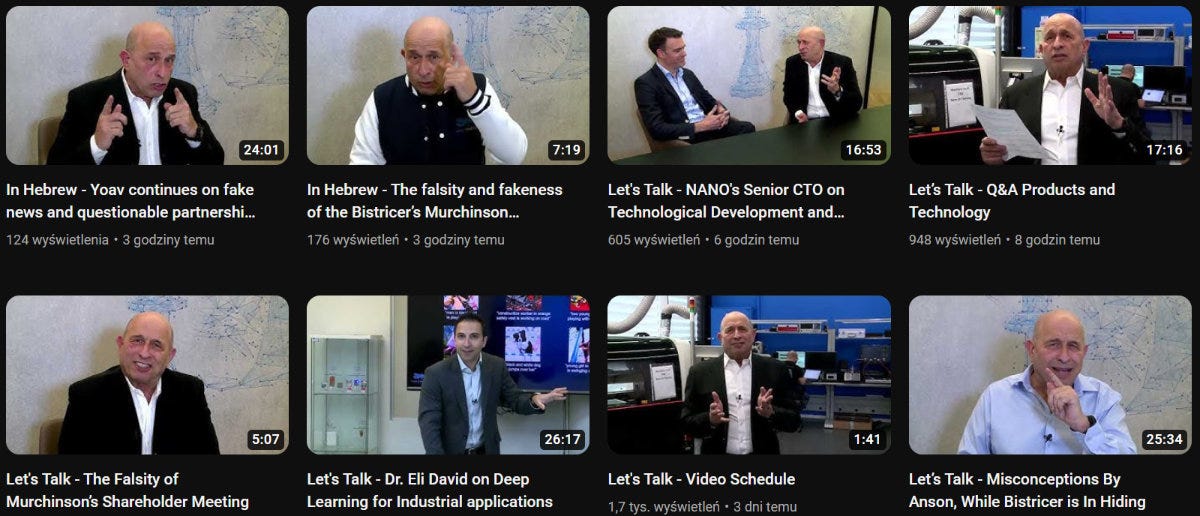

The Stratasys saga is crucial to understanding the current situation. It was the bizarre actions surrounding this episode—YouTube videos urging shareholders to sell their shares while insulting the Stratasys board (now removed), press statements, successive counteroffers, and the burning of cash on lawyers, advisors, accountants, and marketing specialists—that prompted one of Nano Dimension's shareholders, Murchinson, to take matters into its own hands.

The Great Murchinson Feud

The conflict between Nano Dimension and Murchinson Ltd. stems from differing approaches to management and strategic decisions regarding mergers and acquisitions. According to the shareholder, the company is failing to deliver on promises to develop and increase sales of its proprietary technology. Instead, it is burning through funds on a series of acquisitions of companies that do not necessarily operate in the same industries.

Nano Dimension, on the other hand, is pursuing expansion through acquisitions, including this year’s high-profile targets—Desktop Metal and Markforged—which it plans to acquire entirely in cash.

Murchinson criticizes this strategy, pointing out a lack of clarity in strategic goals and overly optimistic assumptions regarding these acquisitions. The purchases of Desktop Metal and Markforged are seen as risky, despite their potential to boost Nano Dimension’s revenues from $14.7 million (Q3 2024) to approximately $340 million annually, based on these companies’ 2023 financial results.

Now, at the annual general meeting of shareholders on December 6, 2024, significant changes were made to the board of directors. Two members, Yoav Stern and Michael Garrett, were removed from the board. They were replaced by Murchinson representatives: Ofir Baharav and Robert Pons. Earlier, on November 21, 2024, Murchinson secured a court decision in Israel allowing it to appoint two other nominees to board positions—Kenneth Trauba and Dr. Joshua Rosensweig.

Although Stern remains in his role as CEO, his position has been weakened, and his compensation has been adjusted (downward).

The changes in the board introduce divisions and potential challenges in making strategic decisions. The combination of differing visions within the board and Murchinson’s increased control over the company’s key actions could slow decision-making processes and weaken Nano Dimension’s ability to execute complex projects, such as integrating the acquired companies.

What’s next?

As of now, nothing is certain. Theoretically, the formal acquisition of Desktop Metal is expected to be completed by the end of the year—without which the company effectively ceases to exist, as it has run out of funds. Markforged has a chance to survive, but the word “survive” does not inspire optimism for the company’s future. Time is running out, and the problems are growing rather than diminishing.

Moreover, even if the formal merger does happen, the real challenge will only begin with the process of integrating everything into a cohesive whole—a true rodeo lies ahead.

Atomic Layer from the Past:

12-08-2021: Xometry acquired Thomas.

News & Gossip:

Paradoxically, the turmoil surrounding Yoav Stern and the new directors has positively impacted Nano Dimension’s value. The company is now worth $533 million, an increase of $55 million compared to last week.

Eplus3D has a new distributor in Poland—3D Phoenix (distributor of Nexa3D, Markforged, Meltio, SPEE3D, among others).

You should read my tomorrow’s LinkedIn newsletter, where I delve into the free money fever and the rampant cash burn by AM companies.