Zortrax’s last rodeo

Zortrax is in the emergency room, but claims it will be the market leader again in four years

There was a certain — brief — time when Zortrax was one of the leaders in desktop 3D printing worldwide.

This success was admittedly built on a gigantic lie, but it’s a fact that Zortrax 3D printers were top-notch.

The Zortrax M200 elevated desktop FFF 3D printing to a level that at the time was unattainable for anyone else. This 3D printer, on one hand, stood in complete opposition to the direction the industry was heading, but on the other, it was exactly what the market wanted.

While some thought they knew what people desired, Zortrax gave people what they truly wanted.

Just as Josef Průša did later. And then Bambu Lab. Yes, historically, Zortrax stands alongside them.

But that was a long time ago, and few remember it. Today, Zortrax is a forgotten brand, recalled only by people like me. Those for whom 3D printing began with Bambu Lab or the Prusa i4 have likely never even heard of such a name.

However, this isn’t another article about the history of 3D printing. This one is very much up-to-date.

Zortrax is essentially dying, lying in intensive care, but it’s still conscious, still fighting. It claims that with every moment, it’s feeling better and recovering its strength.

Any moment now, it will stand on its feet! It will leave the hospital. This time, it will really get its act together.

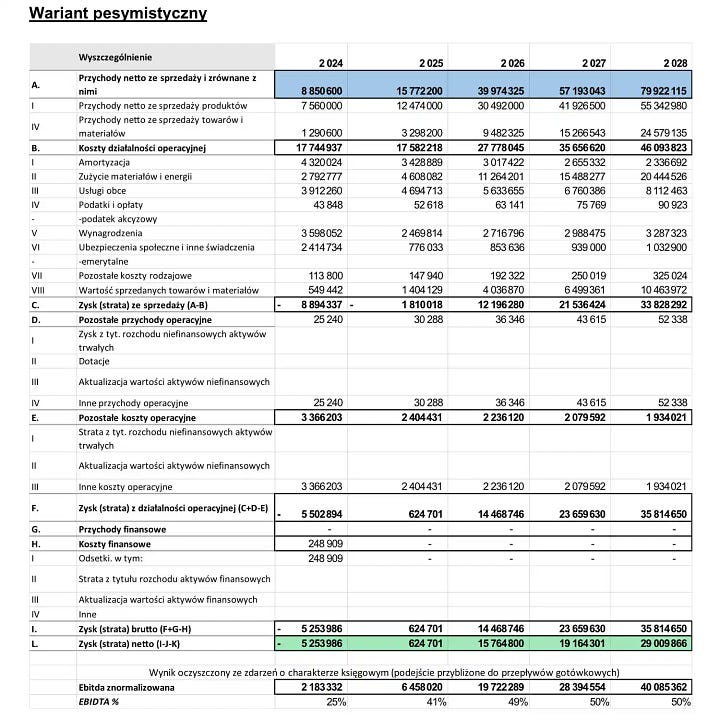

And when it does, it will return to the top. It will make a lot of money. In the pessimistic scenario — by the end of 2028, it will achieve cumulative revenue of 201,712,283 PLN (~50 million USD) and cumulative profit of 59,309,682 PLN (~14.8 million USD). And in the optimistic one…? Nearly twice as much!

All of this is on paper. Officially. These are not lies. This isn’t DELL…

Why did Zortrax fall so low?

There are two answers to this question — the official one, documented in official papers, and the unofficial one.

Here, you will only learn the first. Why won’t you learn the second? Well…

—DISCLAIMER—

Zortrax and I have a history. I was the first to publish the infamous news about the sale of 5,000 3D printers to DELL, which never happened.

When I wrote and published that, I obviously didn’t know the truth. I wrote what Rafał Tomasiak — the then CEO — told me.

You might ask if I verified it somewhere? Well, no, I didn’t. That’s why you have every right not to call me a “journalist” but a “blogger”… I’ve come to terms with that. It was over 10 years ago…

I was the first to write about the sale of 3D printers to DELL, but then I was also among the first to realize something was off…

Fairly quickly, by the second half of that same year, I received unofficial information that the transaction hadn’t taken place. But I couldn’t get official confirmation. And without official confirmation, it was just an allegation…

Because, you see, Zortrax used the information about the DELL contract to sell bonds. I couldn’t just make allegations because that would entail criminal liability.

However as for Zortrax, nothing bad ever happened to them for that. Even when Michael Molitch-Hou finally wrote the truth on 3DPrint.com in August 2016. And John Biggs from TechCrunch confirmed it beyond any doubt.

That’s how it is in Poland. Sometimes you get away with things.

During those two years, my relations with Zortrax were awful. We hated each other. I wrote articles about them on the Centrum Druku 3D portal — they did their own things… It was bad.

Then, in 2017, new people appeared at Zortrax, and they convinced me and the Zortrax management to reconcile. To stop destroying each other.

Which we did. We started cooperating with each other. There was no love between us, but there was professionalism. All in all, I remember the years 2017–2019 quite well. But then the pandemic came, and that was the end of everything… Also of our cooperation.

—END-OF-DISCLAIMER—

So, the official story of Zortrax’s downfall begins here — at the turn of 2019 and 2020, (unofficially, it started earlier, but I have no written evidence for that; no evidence = slander, so…).

From the beginning, Zortrax manufactured its fantastic 3D printers in China. That in itself is quite a story, but not for today.

Anyway, until the end of 2019, it worked as it should. The 3D printers supposedly arrived in Poland from China by train (so Zortrax claims).

When the COVID-19 pandemic broke out, the trains stopped arriving. And when they got back on rails, they brought less and less cargo.

Let’s hear from Zortrax:

During the COVID-19 pandemic, the company was forced to face the following problems, which hindered its day-to-day operations; they faced enormous challenges with:

- the unavailability of 3D printer components, particularly microprocessors and microcontrollers;

- the unavailability of certain petroleum-derived raw materials for producing 3D printing materials;

- very high logistics costs, coupled with a significant decline in their quality (i.e., a considerable extension of delivery times).

As a result, delivery times increased significantly in just one quarter. Consequently, inventory turnover ratios rose, which meant an increased demand for working capital. In a situation of increased working capital demand, ZORTRAX’s main problem became excessively high fixed costs.

Let me translate that into plain language:

Sales drastically declined — partly due to the lockdown, and partly due to the physical lack of 3D printers to sell.

Fixed costs remained at the same level but started to rise over time (inflation + tax changes and associated wage increases in Poland).

So revenues decreased — costs increased.

There wasn’t enough cash to meet current obligations — new debts appeared.

Banks became more restrictive in granting loans, which, combined with the deteriorating financial situation, meant that Zortrax was cut off from new funds.

The debts grew more; layoffs began.

The solution to Zortrax’s problems had long been a major investor. In 2016, one appeared — Dariusz Miłek, one of the wealthiest people in Poland, the owner of the footwear retail company CCC.

Shortly after Miłek invested in Zortrax, the whole truth about DELL came to light. So Miłek got angry, felt deceived, and left the company.

After a few years, a new investor appeared — Rusatom — Additive Technologies. A Russian company belonging to an energy giant.

And just when the companies were negotiating the sale of Zortrax to the East, do you know what happened?

Russia invaded Ukraine. The deal died. No Polish company will be able to sell to Russia for a long time.

So, in 2022, Zortrax was left with nothing. Except for mounting debts.

It was a vicious circle. Less and less cash, fewer and fewer 3D printers produced, decreasing sales, less and less cash in return…

This is how it all went down. As I mentioned, there’s more to the story, but the pandemic and war in Ukraine really wreaked havoc on Zortrax. This is no exaggeration. It’s not an excuse.

Alright, so what’s next…?

A very bad financial situation

For several years now, Zortrax has been sinking into a financial quagmire. I’m not sure if there’s anyone in the Polish 3D printing industry who believes in their recovery?

Once, Zortrax was above us all — today, it’s in the gutter. Seriously. It’s very sad, but that’s the way it is.

Zortrax is listed on Poland’s NewConnect stock exchange (NCIndex). But this isn’t a “real” stock exchange — it’s a market for small or very small companies. ”Pennie stocks”. The real stock exchange is the Warsaw Stock Exchange (GPW).

This year, NCIndex is already down by almost 14%. Since it was first calculated, it has lost around 74%. Out of 16 full years of calculation, 10 ended with a negative annual return, and in 7 cases, the decline was 20% or more.

And now, pay attention! According to financial and stock market media: “Zortrax is a classic example of a company listed on NewConnect!”

Its shares are currently trading around 10 groszy (0,1 PLN), while in 2020, they were priced at over 8 PLN when its backdoor entry to NewConnect was announced. It is currently valued at 13 million PLN. The share price has dropped by over 96% in three years — the largest decline among all companies currently listed on NewConnect.

Source: Bankier.pl

But for some reason, Zortrax’s management doesn’t want to accept this. They want to regain their former glory (at least officially…)

So, they decided to restructure everything. They announced this in mid-May 2024. Now, in mid-August, they announced that they managed to adopt a restructuring plan (Zortrax has several owners who don’t necessarily always agree on everything).

Zortrax submitted a restructuring plan to the court

Zortrax, once a leading manufacturer of desktop FFF 3D printers in Europe, has been facing significant financial difficulties for some time. In May, the company announced a restructuring. Now, it has submitted a report from the arrangement supervisor to the Polish court, indicating that a partial arrangement has been accepted, along with a list of credi…

They sent their plan to NewConnect’s regulatory authorities, and the stock exchange published it.

And in this restructuring plan, they wrote something like this…

Zortrax’s dream of greatness

First, Zortrax writes that the 3D printing market is continually growing. That’s true — it is growing. But this doesn’t necessarily translate into an increase in company values. On the contrary, the value of many companies is currently declining.

But okay, the market is growing and will continue to grow. Great.

Zortrax then mentions plans to create a new 3D printer. Although, in their restructuring plan, they noted that they laid off most of their staff (from over 100 employees during the pandemic to maybe 20 now), so it’s unclear who will actually design this new 3D printer.

However, they also stated that everything will be outsourced. So maybe someone else will create this new 3D printer? I don’t know? Maybe someone in China?

As far as sales as concerned Zortrax claims to have a large number of resellers worldwide. Well, they used to, but after they stopped delivering products, they lost most of them. A reseller needs 3D printers to sell and make money. If they place orders and don’t receive the goods (which was the case…), they stop ordering.

Regaining trust in sales business is a difficult task, especially when you’ve laid off your salespeople…

Then Zortrax says they will primarily sell online. This contradicts what was written above, but never mind… Let’s move on.

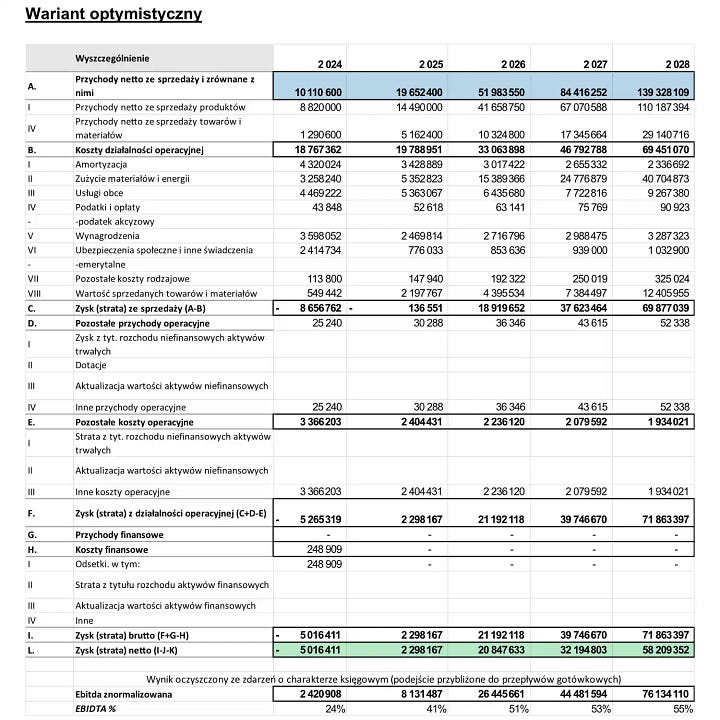

Finally, we get to the numbers!

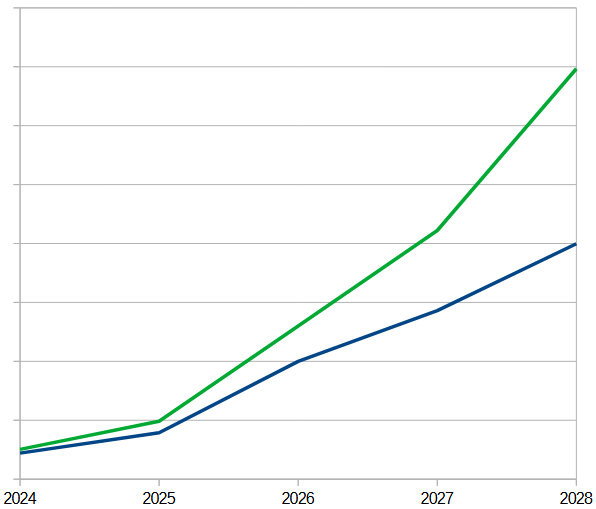

Let me explain what you’re looking at…

The first table represents the pessimistic scenario, and the second one is the optimistic scenario. The tables are originally black and white, but I’ve highlighted the sections to make it easier for you.

The areas in blue represent projected sales revenue. The areas in green represent projected net profit from sales.

All the figures are provided in Polish złoty. The dollar exchange rate is about 4 zł, so you can divide all the numbers by 4 to get a sense of the situation.

This is how these revenues projections look on a chart I created (blue line for pessimistic, green line for optimistic scenario):

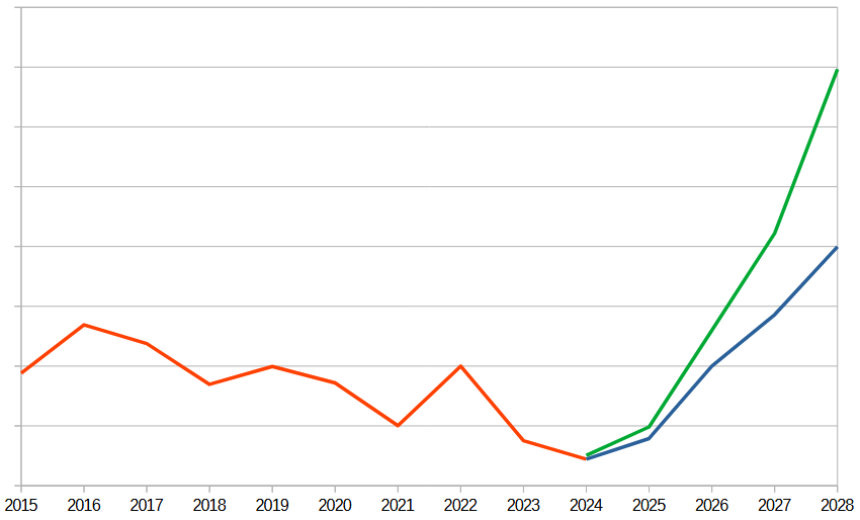

And this is how Zortrax’s real historical revenues look when you combine them:

Just so you know: Zortrax achieved its best result in history in 2016, when its revenue amounted to 53.8 million zł. It exceeded 40 million zł in revenue only twice (2017 and 2022). In 2019, it was on the border (39.87 million zł).

2015 = 37 600 000 zł

2016 = 53 808 271 zł

2017 = 47 535 593 zł

2018 = 33 899 345 zł

2019 = 39 872 695 zł

2020 = 34 386 961 zł

2021 = 20 083 500 zł

2022 = 40 153 011 zł

2023 = 15 037 016 zł

Zortrax doesn’t explain how they plan to achieve these goals. What I’ve described above is all there is. You can translate the original document and check for yourselves. There’s really nothing there.

You might ask, why write such things and publish them as official documents? Well, it’s just a plan… A lot of things can change along the way, right? For example — everything… And then there will be another excuse.